This is a common question when doctors are completing their residencies with hundreds of thousands of dollars of debt. This document will try to provide insights to allow logical approaches to debt and investing. Physicians should consult advisors for personalized plans, as we are attempting to only cover concepts, and apply mathematics to demonstrate likely solutions.

The goals of this document will be to introduce basic investment concepts within the framework of a physician’s income and risk tolerance, blending the payment of debt with investment for the future. We can rely on the past for guidance, but will look forward to try to identify potential scenarios to consider.

Investments Grow Exponentially. Debts Decay Exponentially.

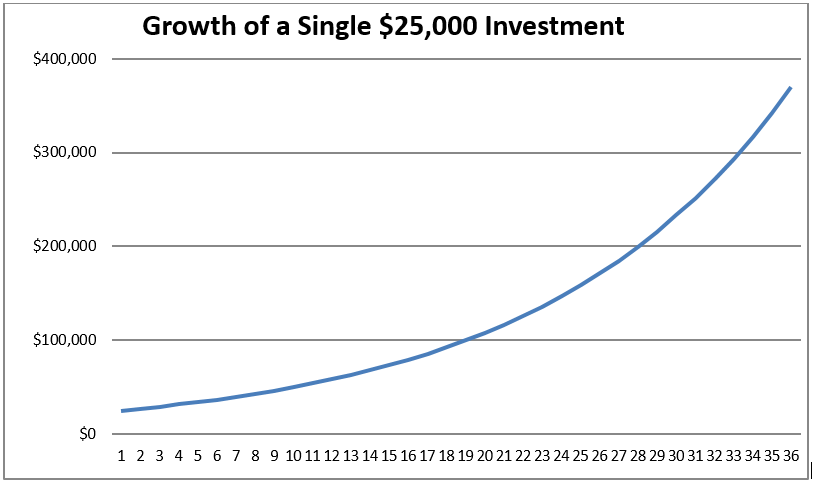

Albert Einstein once said “Compound interest is the eighth wonder of the world. He who understands it, earns it … he who doesn’t … pays it.” Because your principal is constantly growing, the interest grows faster and faster over time. You can’t easily make up for lost time. The first money in has the advantage of the longest period of growth. Looking at a single $25,000 investment over 30 years, we will look at the investment curve at an 8% interest rate. (The stock market averages 10% per year, but a mix of bonds lowers the return.)

Mathematically, the investment doubles every 9 years. (The “rule of 72”, also attributed to Einstein, tells us the years for an investment to double is 72 / interest rate.) Looking at this graph, if you contribute $25,000 your first year in practice, it will be worth $370,000 on your first day of retirement at 66 years old. If you wait 8 years, it will only be worth $200,000. Certainly, it is clear that you can’t afford to wait! If you invest $25,000 per year, it becomes even more profound.

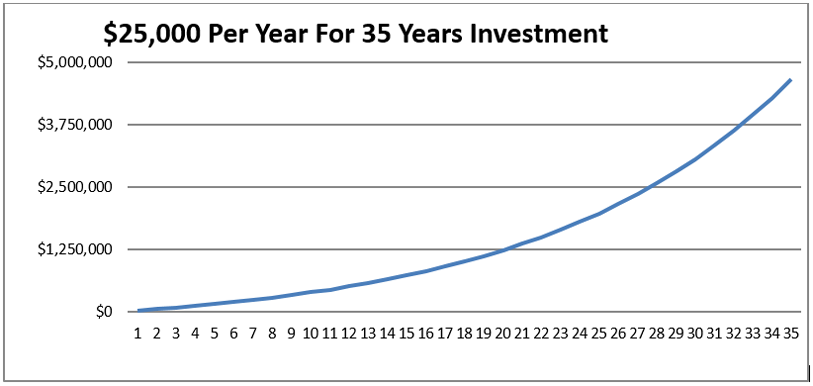

If you invest $25,000 per year for 35 years, the numbers get to be really big. More on this later, but the graphic above shows how $875,000 of contributions grows to $4,652,554 in 35 years. (Start at 20, end at 65,)

Debt Repayment

It is well established in behavioral psychology that losing is felt significantly more than winning. This translates into how we view debt. Inherently, most people want to pay off their debt as quickly as possible. But when the number is large, we feel overwhelmed!

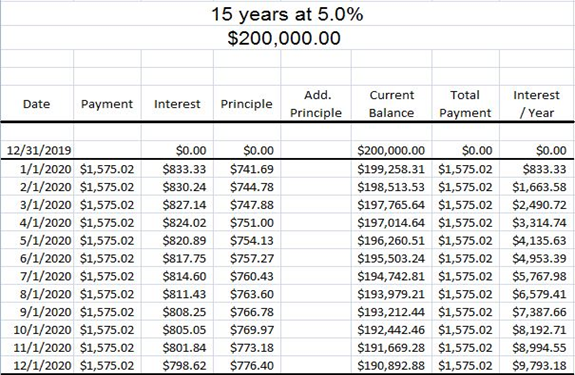

| Like everything else, if we look closely at the math, we can come up with strategies for repayment of loans. Each month, the bank does a calculation, determining the interest on the balance of the loan. The interest is paid first, with the remainder going to the principle. Intuitively, we can understand that the further along in the loan we are, the more money goes to principal, and the faster the loan is paid off.

Looking at my fictional 15 year, 5% loan of $200,000, we can see how adding additional principal accelerates the repayment of the loan. What would happen if we could accelerate the principle repayment, and lower the interest. How quickly would that accelerate the payment of the loan, and how much money would it save. |

|

Using the same calculator, we add the assumption that we will make an additional loan payment of $1,000, or $2,000, per month. This shortens the loan from 15 years to 7 years or 5.25 years. Total Interest paid over the term of the loan falls from $85,266 to $42,144 or $28,187, depending on the additional principal.

Recognizing that repayment of loans is within your control is liberating. (This works with buying a house also. It is the same calculation.)

Approaches To Wealth

We’ve heard from Einstein. Now I’d like to share some more advice about building wealth.

Practical Advice from a Financial Planner Physician – Doctors make lots of money during their careers. They don’t need to hit home runs. A steady diet of singles with occasional doubles will build a solid nest egg. (Ronald Jaffe, MD – Professional Advisory Services Inc.)

The Millionaire Next Door, Surprising Secrets of America’s Wealthy – Their findings, that millionaires are disproportionately clustered in middle-class and blue collar neighborhoods and not in more affluent or white-collar communities, came as a surprise to the authors who anticipated the contrary. High-income white-collar professions are more likely to devote their income to luxury goods or status items, thus neglecting savings and investments. (Thomas J. Stanley and William D. Danko)

Radio personality Dave Ramsey stresses building wealth by living within your means. He advocates having a 3-6 month cash reserve, paying off all debt, investing 15% of income for retirement, funding your children’s college when they are young (exponential growth), accelerate paying off your home, then enjoying your financial freedom when you are free of debt.

Wonderful advice from all of the above. (Although I will inject that a cash back credit card, that is used like cash, is generating income, so I diverge slightly from Mr. Ramsey. If unpaid, credit card debt can be crushing.)

Likewise, as physicians are high income earners, I advocate maximizing pension contributions and additional savings (the 401(k) shouldn’t be your only savings). Anything you can do to shield income is a long term gain.

Choosing Your Retirement Plan

Doctors usually have many choices of the type of retirement plans. Whether through an employer, or your own corporation, doctors can create generous retirement income. Options include:

Employer Pension

This is a traditional pension, where your employer contributes monies with a target benefit for employees in the future. You can imagine the stress on the employer when interest rates drop or the market falls, and they need to make up the difference. Likewise, there have been abuses in good times. When employees die early, it is possible that families do not get a benefit. As you might guess, these are falling out of favor.

Defined Benefit Plans

A Defined Benefit Plan depends on a variable contribution to meet a defined retirement benefit. If set up improperly, it can cause a drag on your cash flow. If done correctly, it can provide physicians an additional avenue to invest larger sums of pre-tax revenue for retirement.

Defined Contribution Plans

This group of plans are named because you are able to determine how much money is contributed to the plan, with no guarantee of how much will be available to take out of the plan. For this reason, there are no surprises, and they are easier to administer.

The terminology in these plans are:

401(k) – Named after the Tax Code Section that describes it, is an Employer Based Plan

IRA – Individual Retirement Account, is individual based, not from the employer. Funding is much lower.

Roth (IRA or 401(k)) – Funded with after tax dollars. Grows tax free, and distributes tax free. 401(k) $19,500 / year ($26,000/year after 50). IRA $6,000 ($7,000/year after 50). Physician makes Roth contribution, employer funds traditional. (Jumbo Roth may be available for employer match.)

Traditional (IRA or 401(k)) – Funded with pre-tax dollars. Grows tax free, and taxed on distribution. With employer match, 401(k) $57,000 / year ($63,500/year after 50) up to 100% of your salary.

Pros and Cons are as follows:

| Feature | Traditional 401(k) | Roth 410(k) |

| Upfront Tax Break | Yes | No, Taxed when contributed. |

| Withdrawals | Taxed at future rate | Tax free |

| Contribution Limits ( / over 50) | $19,500 / $26,000 | $19,500 / $26,000 |

| Maximum Employer Match | Up to $57,000 / $63,500 | Same limits, match usually traditional |

| Income Limits | No | No |

| Payroll Deduction | Yes | Yes (Tax Deducted from Income) |

| Withdraw without Penalty | > 59.5 yo | Contributions any time, Interest >59.5 |

| Required Minimum Distribution | Yes | Not during owner’s lifetime |

| Investment Choices | Many | Many |

| Maintained by | Employer | Self or Employer |

https://www.investopedia.com/ask/answers/100314/whats-difference-between-401k-and-roth-ira.asp

https://www.investopedia.com/ask/answers/102714/what-are-roth-401k-contribution-limits.asp

It is possible to have both a Roth 401(k) and a Traditional 401(k), but you cannot exceed the limits of total donation. In 2020, a Jumbo Roth was created, allowing up to $57,000 / $62,000 Roth contributions. Needless to say, you need to speak to your employer and accountant about this.

https://www.nerdwallet.com/blog/investing/mega-backdoor-roths-work/

How Do You Choose Which Retirement Plans To Invest In?

One simple approach is to ask, when do I want to pay taxes? If you believe that taxes will be lower when you retire, you would want to defer taxes until that time. If you believe taxes will be higher when you retire, you might want to pay them now. Another choice deals with flexibility on how, and when, funds are available.

Years ago, when physician’s incomes were lower, and contribution levels were less than half of what is now allowed, the calculation was much easier. When you retired, your income would be lower, and you would pay a lower tax rate. There were no Roth 401(k) options until 2006.

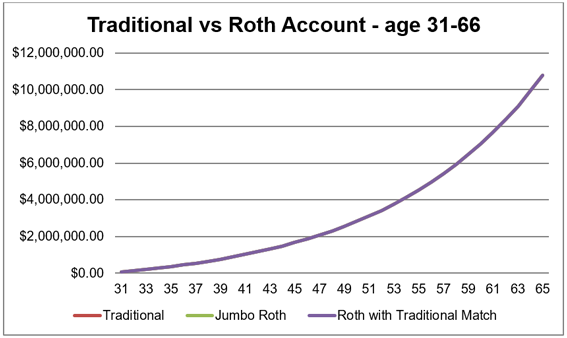

To help your analysis of the these plans, given tax rates in March, 2019 and contribution limits for 2020, for a new graduate, I will present graphics comparing retirement benefits at 66 years old for each. Please note, there are lots of assumptions that may change in weeks to months from now. Stock market assumption of 8% average annual yield.

Because a Jumbo Roth 401(k), Traditional 401(k), and Mixed Roth 401(k) and Traditional401(k) all fund the same amount, accumulation is the same. However, it costs more to fund the Roth up front, because taxes are paid on the money as it is funded.

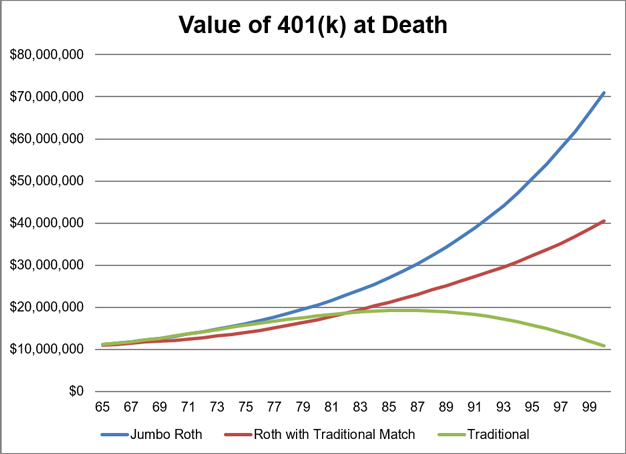

Now comes the fun part. What happens after taxes? If we take $500,000 tax free from the Jumbo Roth, a minimum of $500,000 from the mixed 401(k) and $500,000 from the Traditional until mandatory payments at 70 yo., then using mandatory distributions, the comparison looks like this. (Please note that all incomes are shown as after tax dollars.)

Remember that Traditional 401(k) require distribution after age 70, so income increases to empty the funds from the account! Taxes need to be paid on the distribution, so although there is initially $500,000 in income, taxes consume a little over $200,000 of the funds. Later in life, minimum distributions cause income to swell, and savings to dwindle. You can see the effect on the “Value of 401(k) at Death” chart.

Roth IRAs maintain more money, tax free, and growing in the sheltered account. When $500,000 is distributed, there is no tax to pay. There are no minimum distributions.

We tend to think of our net worth starting to decline when we retire. Actually, with proper savings, it is likely that our income will continue to grow.

So, in retirement, you can live on income that is similar to what you made in practice. How much is left for the kids? The answer depends on how long you live!

Summary

Returning to the initial question, yes, you can afford to save for retirement. In fact, you can’t afford to not start investing as early as possible at your new job!

Using a Mixed Roth and Traditional 401(k) or a Jumbo Roth will maximize flexibility and inheritance for your children. The downside of the Roth 401(k) is paying taxes on the income when it is funded.

The decision to pay down debt versus invest is a personal one. It also depends on what your loan interest rates are. One argument is that your money can earn more in investments (average 10%/year for the S&P 500) than you can save by paying down debt early (for example if your loan interest rate was 3%). Market returns, however, fluctuate. The other argument is that having no debt makes you much more resilient if the economy crashes, you lose your job, or some other unforeseen misfortune were to occur. This lack of predictability, as well as a host of other individual circumstantial differences from person to person, is what makes this decision a personal choice.

This paper has shown that your best investment when starting a new job is to live modestly for a few years while you accelerate debt payment and maximize investment. Stay within your means, and you will have professional financial success. Happy investing!

Remember, this is not professional financial advice! It is an introduction to your financial future. Please consult an expert to create a comprehensive plan focused on your needs.

Thank you to David Jaffe, MD of Professional Advisory Services Inc. for proofreading to assure clarity in 401(k) options.

Article Written by Todd Primack, D.O., FASA